- The Peel

- Posts

- Closing on a Sigh

Closing on a Sigh

Stocks slipped for a third straight day as 2025 heads toward the finish line.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Limited movement ahead of the New Year

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Morgan Stanley

Lesson from the Library: Learn the frameworks and thinking styles that help you ace every case.

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

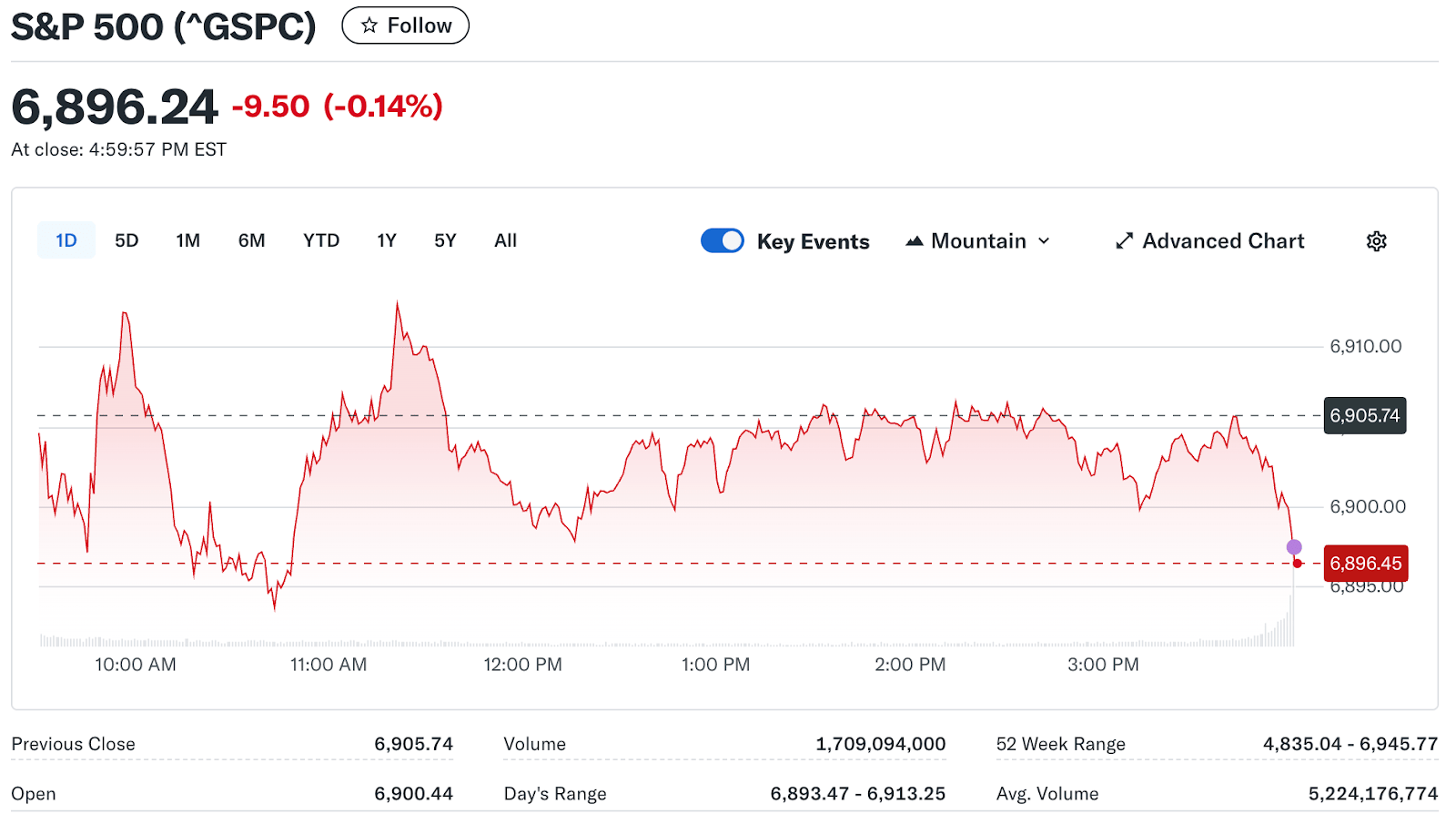

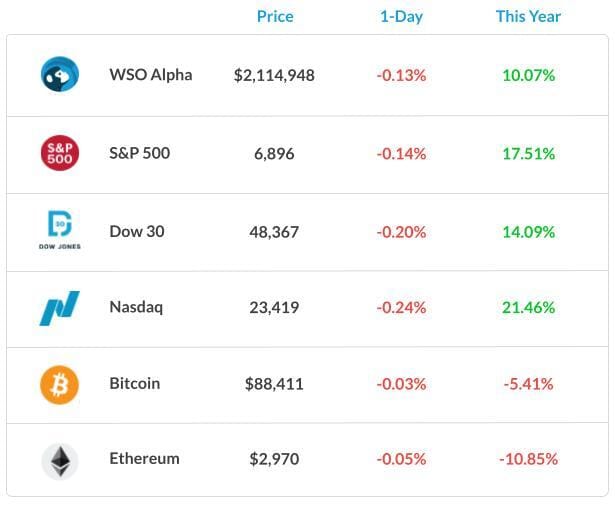

Market Snapshot

📉 Banana Bits

Stocks slipped for a third straight day as 2025 heads toward the finish line.

Gold and silver fell while the Dow closed lower in thin holiday trading.

U.S. stocks eased off record highs, though global markets are set for strong 2025 gains.

The S&P 500 and Nasdaq edged down in quiet trade, while Meta rose on deal news.

U.S. equities shrugged off “Sell America” calls and are ending 2025 near record levels.

The Dow dipped after Fed minutes, with two biotech names taking heavy losses.

Market Recap

Limited Movement Ahead of New Year

U.S. markets were mainly mixed today as investors were wrapping up the year. The Dow declined slightly, while the S&P 500 and Nasdaq were unchanged, as trading volume was low today.

Investors remained cautious after recent market gains and chose not to make big moves ahead of the new year. Technology stocks cooled off a bit after helping drive the market higher earlier in the month.

In market news, investors continued to focus on expectations for interest rate cuts in 2026 as inflation shows signs of easing.

Global markets reflected similar caution, with European stocks trading mixed and Asian markets reacting to movements in the U.S. tech shares. Oil prices declined slightly after recent gains, indicating concerns about global demand.

What's Ripe

Meta Platforms (META) 1.1%

Meta shares increased by about 1.11% today after the company announced it will acquire the AI startup Manus, which gives investors greater confidence in its AI strategy.

Confidence around future growth helped support the stock.

Boeing (BA) 0.6%

Boeing’s stock rose a bit as part of the broader DOW gains today, which is due to the positive contract news and sector interest.

What's Rotten

Tesla (TSLA) 1.2%

Tesla’s stock went down today as investors took profits after recent gains. Some investors were also cautious about near-term EV demand, which put pressure on the stock.

Nvidia (NVDA) 0.4%

Nvidia declined slightly today as tech stocks all settled today.

Lower enthusiasm around big tech names kept Nvidia under pressure in the holiday trading season.

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

📚 Lesson from the Library

🎥 Consulting Case Interview Course: Crack the Consulting Playbook

Learn the frameworks and thinking styles that help you ace every case.

🌟 WSO Academy Q4 Update

📊Automatic Session Notes + Key Takeaways Emails

When a student’s mentor uploads a session recording, they’ll now receive a short follow-up email summarizing:

✅ Key takeaways from the session

✅ Action items / next steps

✅ Links to any resources mentioned

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

OceanFirst and Flushing Financial agreed to merge, backed by a $225M Warburg Pincus investment.

DigitalBridge signed several material agreements tied to its growth plans.

New Horizon expanded its wound-care lineup with the Applied Tissue acquisition.

Baker McKenzie advised Credicorp on its purchase of Helm Bank USA.

Soulpower Acquisition provided an update on its planned SWB business combination.

📊The Daily Poll

If global markets outperform the U.S. in 2025, the smart shift is toward: |

Previous Poll:

China's 87% surge in EV exports puts pressure on:

Global automakers: 61.1% // Trade policy: 19.4% // Margins worldwide: 8.4% // Supply chains: 11.1%

Banana Brain Teaser

Previous

If x is the product of the integers from 1 to 150, inclusive, and (5)^y is a factor of x, what is the greatest possible value of y?

Answer: 37

Today

An investor purchased 100 shares of Stock X at $6.05 per share and sold them all a year later at $24 per share. If the investor paid a 2% brokerage fee on both the total purchase price and the total selling price, which of the following is closest to the investor’s percent gain on this investment?

Art is a hedge against the failure of money.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick