- The Peel

- Posts

- Cheaper Model Y Coming

Cheaper Model Y Coming

Tesla plans to unveil a cheaper version of Model Y after loss on U.S. EV incentives.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: AI stocks soar as OpenAI partnerships fuel rally

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Moelis

Deal Dispatch: M&A, IPOs, and other transactions

The Daily Poll: See how you stack up

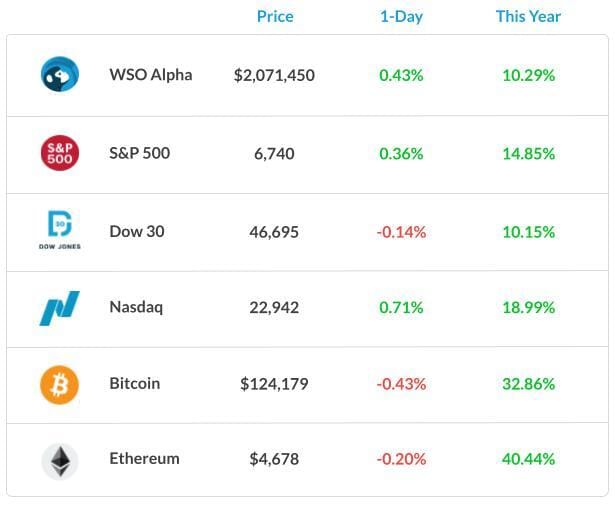

Market Snapshot

📉 Banana Bits

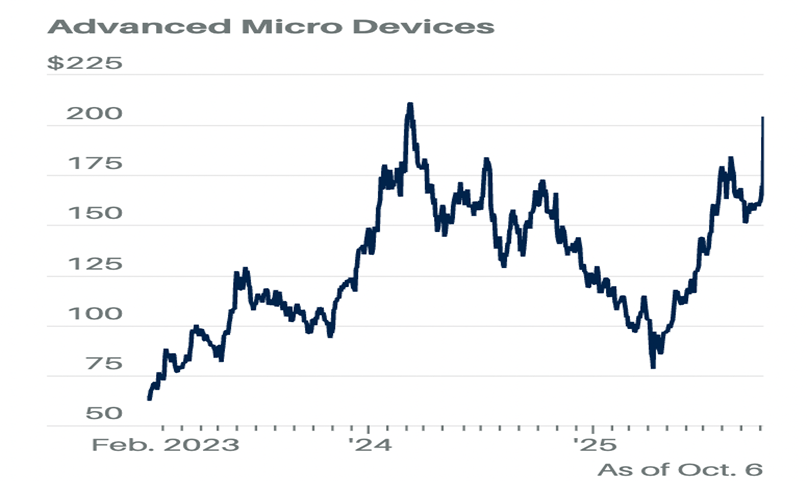

AMD stock soared after the company landed a huge deal with OpenAI.

An ex-Morgan Stanley banker was appointed CFO of xAI by Musk.

Citadel Griffin says that investors view gold as a safer asset than the Dollar.

Tesla plans to unveil a cheaper version of Model Y after loss on U.S. EV incentives.

Tariffs on U.S. heavy truck imports will begin on November 1.

B*tcoin option traders are in extreme bullish, eyeing a $140,000 record rally.

U.S. consumers are expected to increase spending by 5.3% in 2024.

Market Recap

Another Win for AI Stocks led by OpenAI

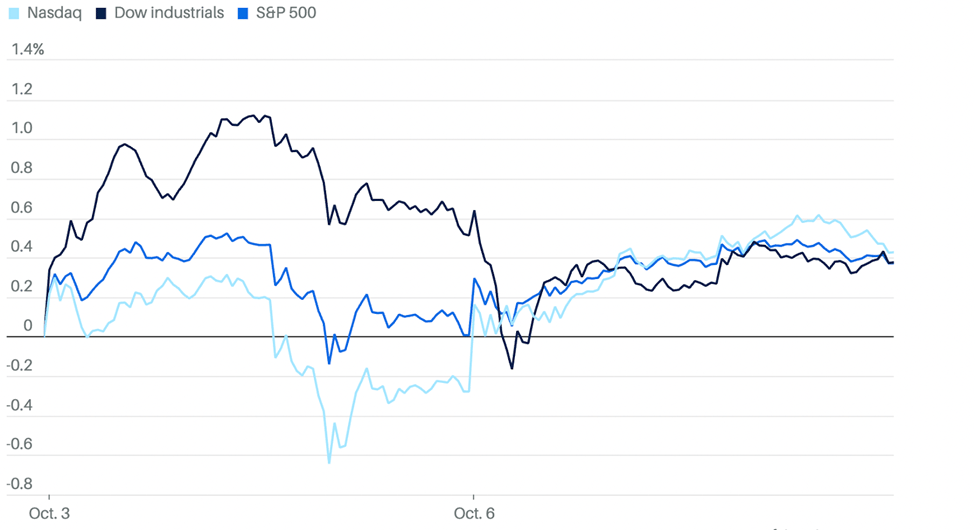

Monday's trading was another win for the S&P 500, pushing the index for a seventh consecutive trading day.

The S&P 500 was up 0.4%. The Nasdaq Composite was up 0.7%. The Dow Jones Industrial Average dropped 63 points, or 0.1%. The Russell 2000 was also on track to join the S&P with its seventh consecutive gain and mark its third closing high of the year.

The yield on the 2-year Treasury note was up to 3.6% and the 10-year yield was up to 4.16% as traders sold Treasury bonds. Traders see a 94.6% chance that central bankers opt for another quarter-point cut during the Oct. 28-29 meeting.

AMD led the rally of the AI world after it announced a partnership with OpenAI to deploy six gigawatts of AMD Instinct graphics processing units. OpenAI will also receive a warrant to purchase up to 160 million shares of AMD at 1 cent a share.

It’s not just AMD that got touted by OpenAI. Figma shares rose 7% in Monday trading after the design software vendor was promoted by Sam Altman in an onstage demo at his company’s annual DevDay conference in San Francisco.

Altman discussed Figma’s integration into ChatGPT, which has more than 800 million monthly users. He showed how third-party applications could plug in with OpenAI’s Apps SDK, or software development framework.

What's Ripe

Comerica Inc. (CMA) 13.7%

The regional lender jumped 13.7% after Fifth Third Bancorp said it would buy its smaller peer for $10.9 billion.

The deal would make Fifth Third Bancorp the ninth largest in the world with assets of $288 billion.

Uipath Inc. (PATH) 12.6%

Path soared 12.6% in Monday trading after the company announced a slew of partnerships.

The company had partnerships with big AI names, including Nvidia and OpenAI.

What's Rotten

Applovin Corp. (APP) 14.0%

APP slumped Monday afternoon after Bloomberg reported the SEC is probing the mobile ad-tech firm's data-collection practices.

Quantum Computing Inc. (QUBT) 10.0%

QUBT was down 10% after announcing that it planned to raise $750 million in an oversubscribed private placement.

The company is planning to sell 37 million shares.

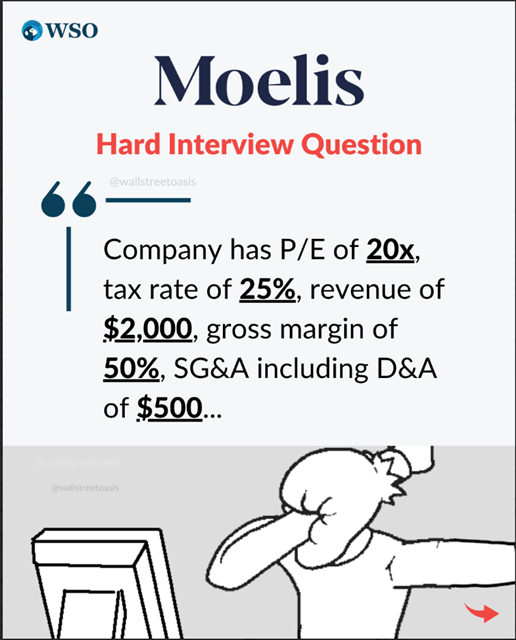

🧠 Technical Trip

Interview Q&A from Moelis

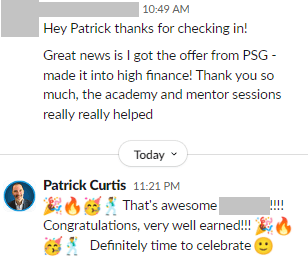

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

🌟 Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Nivedita Bishnoi, put together an impressive deep dive on e.l.f. Beauty, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones.

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

LG Electronics India to begin taking orders for $1.3 billion IPO.

Ex-Generation Partners launches equity fund targeting $1 billion.

Elliott seeks to buy Sumitomo Realty stake from holders.

Qualtrics agrees to buy Press Ganey Forsta in $6.75 billion deal.

Rockpoint raises Toronto IPO to up to C$704 million.

U.S. to take 10% stake in Trilogy Metals to unlock Alaska mining.

IPOs in limbo as shutdown threatens billions of dollars of deals.

📊The Daily Poll

OpenAI partnering with AMD means… |

Previous Poll:

What’s your October game plan?

Stay long: 47.2% // Take profits: 19.4% // Go defensive: 8.4% // Wait and watch: 25.0%

Banana Brain Teaser

Previous

What is the smallest integer n for which 25^n> 5^12?

Answer: 7

Today

The present ratio of students to teachers at a certain school is 30:1. If the student enrollment were to increase by 50 students and the number of teachers were to increase by 5, the ratio of students to teachers would then be 25:1. What is the present number of teachers?

Investing is a business where you can look silly for a long time before you are right.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick