- The Peel

- Posts

- Borders Get Stricter

Borders Get Stricter

Trump rolled out visa crackdowns affecting 75 countries.

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

Silver banana goes to…

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Investors shift from AI darlings to shiny metals

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Blackstone

Deal Dispatch: M&A, IPOs, and other transactions

Market Snapshot

📉 Banana Bits

TSMC blew past expectations, lifting capex plans to as much as $56B.

Trump rolled out visa crackdowns affecting 75 countries.

Trump said he has no plans to fire Federal Reserve Chair Jerome Powell.

New 25% tariffs on select semiconductors now include Nvidia chips.

The Fed’s Beige Book indicates a resilient U.S. economy.

Mining stocks are climbing in 2026 as investors chase safe havens.

Net interest income at major U.S. banks is set to rise as low-yield bonds mature.

Why the Wealthy Are Quietly Ditching ETFs

For years, exchange-traded funds (ETFs) have been the go-to investment strategy for everyday investors. But ETFs aren’t built for tax control. So, while money continues to pour into them, private wealth firms are shifting.

Learn what it means for you.

Market News

Investors Shift From AI Darlings To Shiny Metals

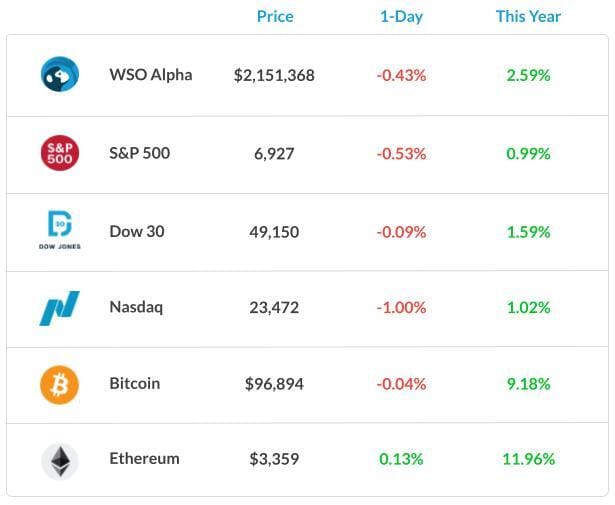

The S&P 500 Index closed 0.5% lower in New York, notching its first back-to-back decline of the year. The tech-heavy Nasdaq 100 Index dropped 1.1%, also adding to losses from Tuesday’s session, almost wiping out gains for the year.

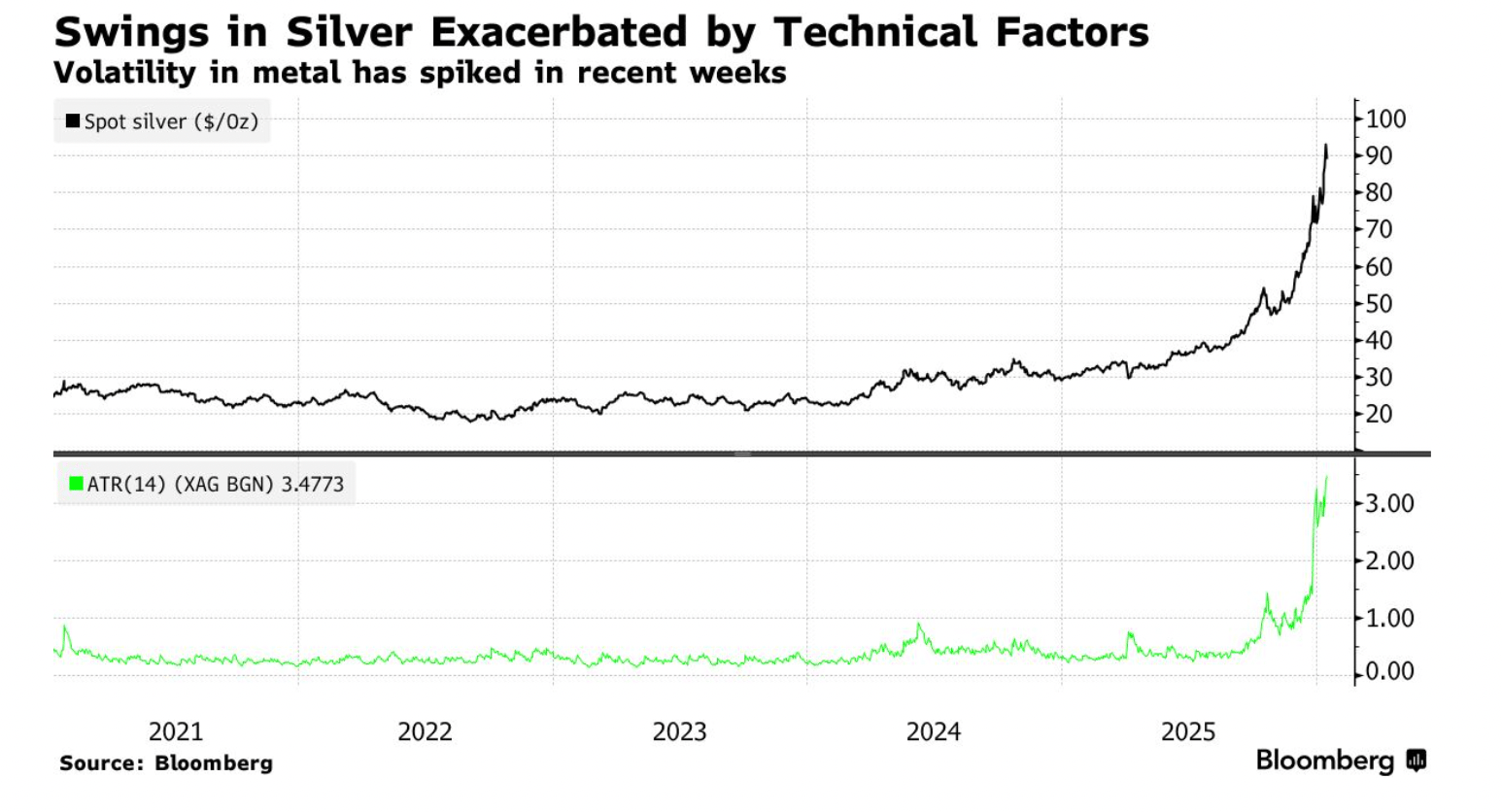

Investors seemed to become concerned about the economic uncertainty that started the year. This prompted Wall Street to switch out from Magnificent 7 darlings to metals, with gold, silver, and copper hitting records.

Small Caps are also getting a reprieve with the Russell 2000 beating the S&P 500 for a ninth straight session, matching the longest streak since 1990.

Banks got mixed results with Wells Fargo & Co. sinking after missing profit estimates, while concern about Bank of America Corp.’s expense outlook offset solid results.

Citigroup Inc. slipped after top executives pushed back on analysts’ optimism that the bank is nearing completion of key regulatory goals and cutting costs. With earnings coming up, expectations have climbed, and markets are pricing in near-perfect results, raising the risk of disappointment if performance falls short.

Lastly, Oil fell for the first time in six days after President Donald Trump signaled he may hold off on attacking Iran for now. Precious metals also slipped from their record highs.

What's Ripe

Intel Corp. (INTC) 3.0%

INTC soared 3.1% to extend its gains from Tuesday’s session, when it closed up 7.3%. The chip maker caught an upgrade from KeyBanc’s Vinh on Monday, who cited strong demand from cloud service providers.

Honeywell International Inc. (HON) 1.3%

HON rose 1.3%. Quantinuum, the quantum computing company majority-owned by Honeywell, said Wednesday that it plans to submit a draft registration statement for a proposed initial public offering.

What's Rotten

AppLovin Corp.(APP) 7.6%

APP sank 7.6% to $617.76, making it a casualty of the tech selloff. Evercore ISI initiated coverage of the stock on Wednesday with an Outperform rating and $835 price target.

Wells Fargo & Co. (WFC) 4.6%

WFC declined 4.6%. The bank posted fourth-quarter earnings of $1.62 a share, missing.

Wall Street estimates of $1.66. Quarterly revenue rose 4% to $21.3 billion, though the number came in below forecasts. Results included a $612 million severance charge, Wells Fargo said.

Other peers, such as Citi and BAC, also slumped with lackluster results.

🧠 Technical Trip

Interview Q&A from Blackstone

👉 Want 1-on-1 recruiting help from Blackstone bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Eastroc Beverage is sounding out demand for a billion-plus Hong Kong IPO.

OpenAI signed a $10B deal with Cerebras for AI computing power.

Brazilian fintech Agibank filed for a U.S. IPO, targeting $1B.

Honeywell-backed Quantinuum plans to file for a confidential IPO.

Japan’s IPO flipping trade is cooling as smaller listings lose steam.

Citigroup’s M&A surge drove an 84% jump in fee income.

Banana Brain Teaser

Previous

The letters D, G, I, I, and T can be used to form 5-letter strings such as DIGIT or DGIIT. Using these letters, how many 5-letter strings can be formed in which the two occurrences of the letter I are separated by at least one other letter

Answer: 36

Today

If n = (33)^ 43 + (43)^ 33, what is the units digit of n?

The big money is made in the waiting, not the talking.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick