- The Peel

- Posts

- BNY and Goldman Go Tokenized

BNY and Goldman Go Tokenized

🤝 BNY and Goldman Sachs are joining forces to tokenize money market funds.

In this issue of the peel:

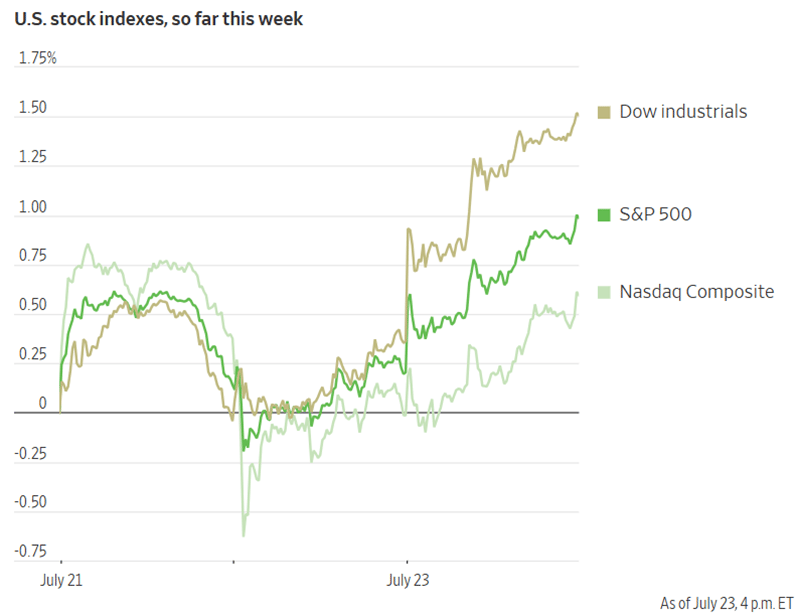

✈️ The S&P 500 hit an all-time high yesterday after Japan and the U.S announced a trade agreement, and the EU and the U.S have “accelerated talks.”

🛢️ Tesla fell short of earnings while Alphabet beat earnings, but the stock fell after they announced additional capital expenditures for 2025.

🤝 BNY and Goldman Sachs are joining forces to tokenize money market funds.

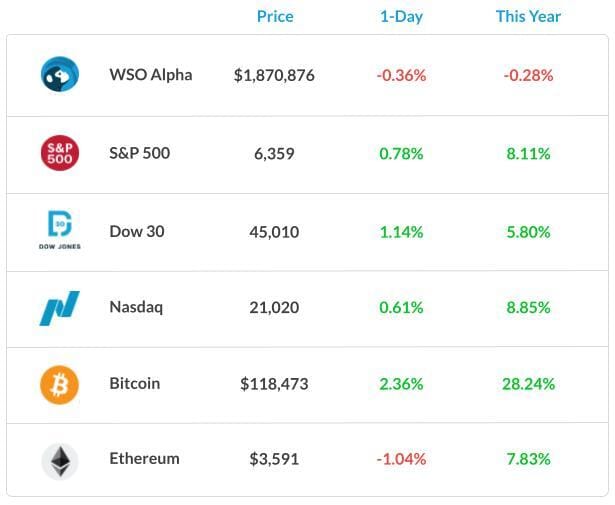

Market Snapshot

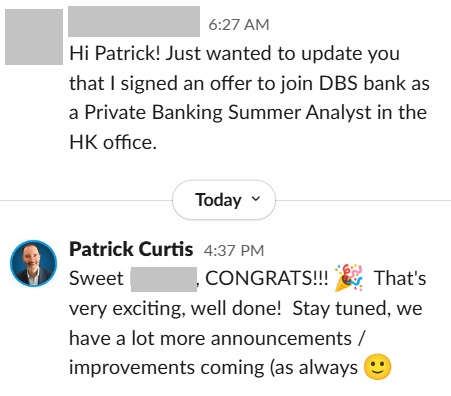

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Sebastian Morar, put together an impressive deep dive on Flywire Corp, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Treasury Secretary Scott Bessent says that there is “no rush” to choose Jerome Powell’s successor.

The SEC halts the approval of Bitwise ETF, indefinitely suspending its launch.

Google crushes earnings, but stock falls after increased spending announcements.

Lawmakers Subpoena J.P. Morgan after, and Bank of America after the IPO of a Chinese battery startup.

Home prices have hit a record high in June, decreasing overall home sales.

The Trump Administration promises to “stimulate AI use and exports.”

The Daily Poll

Is finance going fully digital soon? |

Previous Poll:

Scrap capital gains tax on homes?

Yes please: 50.0% // Bad idea: 28.1% // Mixed feelings: 14.0% // Doesn’t affect me: 7.9%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Musk Signals Pain Ahead

After market hours on Tuesday, President Trump announced that he had reached a trade deal with Japan, lowering tariffs to 15%.

This rate is lowered from the previous rate of 25%, in addition to Japan pledging to invest $550 billion in the U.S., with the U.S. set to receive 90% of the profits from the investments as part of the deal.

Trump also announced that he would not go below 15%, as he sets his “reciprocal tariff rates” before the August 1st hard deadline.

This trade deal with Japan has raised investors’ hopes that more trade agreements will follow, potentially sustaining the current upward trend in markets.

President Donald Trump also announced that he would be meeting with Xi Jinping after Treasury Secretary Steven Mnuchin said the current trade truce between the U.S. and China might be extended.

Additionally, markets are optimistic about the Trump Administration’s ability to reach agreements prior to the August 1st deadline, following accelerated talks between the U.S. and the European Union (EU) that were announced.

Tesla shares dropped as much as 5.3% after hours when the EV company fell short of earnings. Sales and profits missed analyst estimates, with free cash flow also taking a significant nose dive.

Elon Musk also announced that Tesla could see “some rough quarters ahead” after taking a significant reputation hit with Elon Musk’s significant political involvement. Tesla is currently down about 12% YTD, but still up 34% in the past year.

Alphabet, the parent company of Google, reported earnings after hours on Wednesday and beat analyst expectations, but increased its capital expenditures (capex) guidance to $85 billion. This increase in capital expenditures caused the stock to slightly slip in after-hours trading, with the majority of the capex being allocated to AI spending.

Career Corner

Question

I came across this interview question online and was wondering how you would approach answering it. "Which valuation method is the best?"

Answer

Go through the pros and cons of each (briefly, or stick to the one most relevant) and then use that to explain why you think the pros of X make it the best in Y situation (or overall, depending on the exact interview prompt).

Head Mentor, WSO Academy

What's Ripe

Abivax Societe Anonyme (ABVX) 586.00%

Abivax, a clinical-stage biotechnology company specializing in treatments for chronic inflammatory conditions, saw its share price surge yesterday after announcing a successful Phase 3 trial for obefazimod, an oral treatment for ulcerative colitis.

Additionally, optimism surrounds Abivax’s route to FDA approval, boosting investor confidence.

Liberty Energy Inc. (LBRT) 17.8%

Liberty Energy’s stock price surged today after they announced a “strategic alliance” with Oklo, a nuclear startup, to “accelerate the development of integrated solutions.” These solutions are designed for power-hungry customers, such as AI data centers and other high-demand applications.

What's Rotten

Enphase Energy Inc. (ENPH) 14.2%

Enphase’s stock plunged today after the company announced Q3 revenue guidance of between $330 million and $370 million, with the median of the range coming in well below analyst estimates of $368 million. Despite beating earnings in Q2, the weak outlook in conjunction with tariff-related margin pressures weighed heavily on investor sentiment.

Fiserv Inc. (FI) 13.9%

Fiserv, a global fintech company, saw its share price take a sharp dive after reporting earnings, with growth in their merchant solutions at 9%, below the expected range of 11-13%. Fiserv also decreased its revenue guidance after this shortcoming, in addition to pressures on its operating margins, slipping 200 basis points.

Thought Banana

BNY + Goldman: Cash, But Make It Digital

Goldman Sachs and Bank of New York Mellon (BNY) announced yesterday that they are joining forces to create digital tokens that will “maintain an ownership record” of money market funds managed by firms such as BlackRock and Fidelity.

This feat was achieved using Goldman’s “GS DAP” blockchain platform that allows institutional investors to “record tokenized versions of select funds.”

BNY also issued a statement stating that BlackRock, Fidelity Investments, Federated Hermes Inc., in addition to the asset management arms of both Goldman and BNY, would be participating in this new technology.

Some financial institutions are experimenting with tokenized money market funds that utilize blockchain technology to facilitate their use as collateral.

This announcement came just a few weeks after Robinhood, a well-known trading platform, announced its use of tokenized stocks to invest in private companies.

Critics of these digital tokens have said that this utilization of blockchain technology will bring “cr*pto volatility and cybersecurity risks to the traditional financial world.”

On the other hand, supporters of these digital tokens argue that it has the potential to transform financial markets by essentially allowing for “cheaper, faster, and more efficient transactions.

The Big Question: Can blockchain really make traditional finance faster and safer, or is this just rebranding with extra buzzwords?

Banana Brain Teaser

Previous

Of the final grades received by the students in a certain math course, 1/5 are A’s, ¼ are B’s, and ½ are C’s, and the remaining 10 grades are D’s. What is the number of students in the course?

Answer: 200

Today

The probability is ½ that a certain coin will turn up heads on any given toss. If the coin is to be tossed three times, what is the probability that on at least one of the tosses the coin will turn up tails?

Send your guesses to [email protected]

Generally, the greater the stigma or revulsion, the better the bargain.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick