- The Peel

- Posts

- Big Bite from Apple

Big Bite from Apple

Markets hit record highs with Apple stealing the spotlight at $4T.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Wall Street climbs with Big Tech leading the charge

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Morgan Stanley

Deal Dispatch: M&A, IPOs, and other transactions

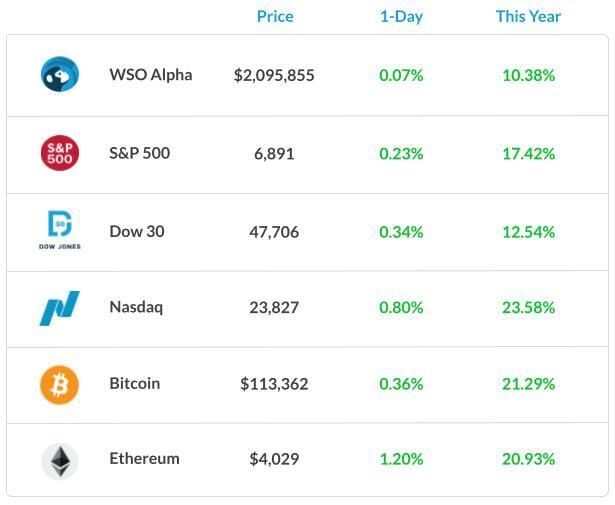

Market Snapshot

📉 Banana Bits

Apple just joined the $4T club; casual trillion-dollar flex.

Consumer confidence slipped a bit as Americans side-eye the future.

Oil prices dipped after OPEC+ plans drowned out the US-China buzz.

B*tcoin’s stuck in place before the Fed’s move; leverage cuts both ways.

Markets hit record highs with Apple stealing the spotlight at $4T.

The Fed might cut rates in October, but no one’s betting their rent on it.

The AI Paradox in M&A: What's Next for Dealmaking?

UpSlide is hosting an exclusive webinar, bringing together thought leaders from KPMG, Forvis Mazars, Nomura, and Model ML to explore the real impact of AI on M&A workflows.

They’ll cover how the largest M&A teams are using AI to reshape the dealmaking experience from analysts to MDs. Plus, they’ll share insights on:

How AI is currently used across the deal lifecycle—and where it’s falling short

What’s missing from today’s strategies—and what could unlock fundamental transformation

The long-term vision: could one prompt generate an entire pitchbook?

You’ll gain actionable insights to streamline workflows, reduce costly review loops, and prepare your team for the next wave of automation—all while having your questions answered live.

Save the date:

📅 November 5th

⌚ 10:00 am ET

⌛ 45 minutes

Market Recap

Big Tech Keeps the Party Going

U.S. stocks ended higher this time around.

The Dow rose about 0.7% to around 47,545, the S&P 500 added about 0.3% to around 6,894, and the Nasdaq gained about 0.55% to roughly 23,788. That keeps the major indexes near record territory as earnings start to roll in.

Big Tech stayed in the spotlight after Apple briefly hit $4T in market value. On the earnings front, UPS jumped about 7% after results beat expectations and its turnaround update landed well. Overall, it was a steady up day, led by mega-caps and select earnings winners.

Rates and commodities were cold today. The 10-year Treasury yield hovered around 3.99%, crude oil slipped about $60, and gold eased to about $3,964/oz. These moves kept macro pressures light while investors focused on earnings and the Fed outlook.

What's Ripe

UPS (UPS) 8.0%

UPS rose after an earnings beat and turnaround update that showcased cost cuts and margin improvement. Investors liked the clearer path to profitability.

Apple (AAPL) 0.1%

Apple climbed after briefly crossing the $4T market-value mark, which boosted confidence in mega-cap technology.

Steady Treasury yields and strong Big Tech sentiment helped buyers stick with large names.

What's Rotten

Exxon Mobil (XOM) 0.8%

Exxon edged lower as oil prices dipped on ample supply signals and a softer demand outlook. Weakness in crude filtered through to energy equities.

Chevron (CVX) 0.7%

Chevron fell as crude oil prices slipped on oversupply worries and a softer demand outlook.

Lower oil prices reduced cash flow expectations, weighing on energy stocks like Chevron.

🧠 Technical Trip

Interview Q&A from Morgan Stanley

👉 Want 1-on-1 recruiting help from Morgan Stanley bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Hologic’s going private in an $18.3B exit move.

Qorvo and Skyworks are merging into a $22B chip giant.

FleetPride and TruckPro are joining forces for a smoother ride.

Huntington’s snapping up Cadence Bank and a few others along the way.

Celanese is trimming down, selling off its Micromax business.

Banana Brain Teaser

Previous

[(0.0036) x (2.8)]/[(0.04) x (0.1) x (0.003)] = ?

Answer: 840

Today

Leona bought a 1-year, $10,000 certificate of deposit that paid interest at an annual rate of 8% compounded semiannually. What was the total amount of interest paid on this certificate at maturity?

The best real-estate deal is often the one you don’t do.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Fernanda, & Patrick