- The Peel

- Posts

- Bean There, Surged That

Bean There, Surged That

Soybeans surge as U.S.-China talks spur hope for trade revival.

Silver banana goes to…

Your Daily Dose of Market & Career Clarity

📬 Delivered to 150,000+ ambitious readers

🎯 In this issue:

Banana Bits: Finance headlines that actually matter

Market Summary: Stocks hit records as job cuts spark concern

What’s Ripe / Rotten: The tastiest and most disgusting stocks

Technical Trip: Interview Question with Moelis

Deal Dispatch: M&A, IPOs, and other transactions

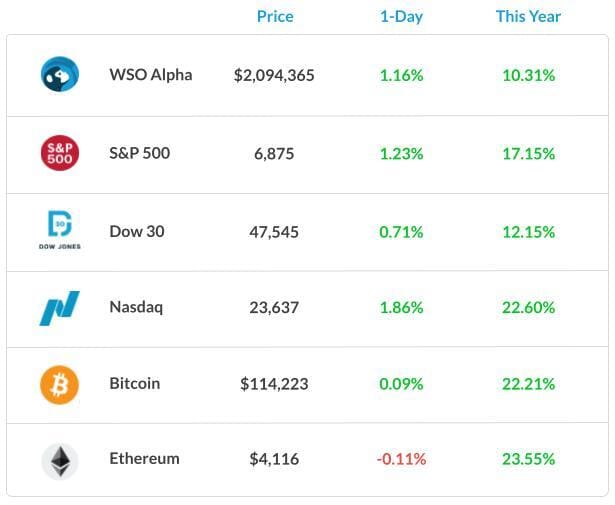

Market Snapshot

📉 Banana Bits

U.S. “made a lot of money” from the Argentina Bailout, according to Trump.

Paramount to ax 1000 in the first round of cuts, and the second wave is also expected.

Saylor’s Strategy has been rated as junk by S&P in its initial assessment.

Is Meta ditching its Metaverse dream after shuffling its top Metaverse exec to AI?

Amazon also joins the wave of cuts affecting almost 30,000 jobs.

Soybeans surge as U.S.-China talks spur hope for trade revival.

Costs to hedge the $16 trillion S&P 500 rally rise ahead of Fed.

Analyst lost confidence in Berkshire following a sell rating.

Your upper hand

In a highly competitive market, deep knowledge of deal terms trends can be a powerful tool in moving to the next level. Build that knowledge with the 2025 SRS Acquiom M&A Deal Terms Study.

This isn’t a regurgitation of publicly available information or a lengthy list of things you and your boss(es) already know. No, every data point and insight comes from SRS Acquiom, the private-target M&A expert. This data draws on more than 2,200 private-target deals, valued at more than $505 billion, that closed between 2019 and 2024. This is invaluable deal terms intelligence from a proprietary private-target dataset you won’t find elsewhere.

Trends in valuations and earnouts, impacts of heightened due diligence, the prevalence of walk-away indemnity structures: It’s all here. So, if you’re looking for a ticket to knowing what’s market on private target deals—the kind of stuff that makes your clients and bosses take notice—this is the closest you’re going to get.

Market Recap

The Job Market is Cracking Up?

Wall Street seems to be getting its bullish lenses ready again, with investors rejoicing over a fragile trade truce between the U.S. and China and expecting lower interest rates after inflation numbers came in soft.

The three key stock indexes: S&P 500, Dow, and Nasdaq all hit records. The S&P 500, which closed up 1.2%, has set its 35th record this year, the most of the three. Dow settled 0.7% higher, and Nasdaq was up 1.9%. Even gains spilled to small companies, with the Russel 2000 rising 0.3%.

It’s all fun and games until the job market is cracking up again. With the government shutdown, layoffs from big institutions might signal a weakening economy and, in turn, a weaker job market.

Yesterday, we got news from Amazon that, as early as Tuesday, up to 30,000 jobs could be affected. This cut would be the largest since 2022-2023, which totaled more than 27,000.

On the other hand, we got Paramount to begin axing 1000 jobs on Wednesday. Lastly, Meta's shift of its Metaverse executive to the AI division suggests the company might be under pressure to cut, following 100 job cuts last week.

What's Ripe

Domino's Pizza Enterprises Ltd (DMP) 17.35%

DMP soared after the Australian Financial Review reported that Bain Capital is considering buying the fast-food chain.

The deal is said to be worth as much as A$4 billion ($2.6 billion).

Qualcomm Inc. (QCOM) 11.1%

QCOM jumped 11% after the semiconductor company introduced its AI200 and AI250 rack server lineup.

This allows the company to compete in an area dominated by Nvidia and Advanced Micro Devices.

What's Rotten

USA Rare Earth Inc. (USAR) 8.4%

SUAR declined 8.4%, and other rare-earth stocks traded lower after Treasury Secretary Scott Bessent said he expected China to defer its tightened export controls on rare-earth materials as a result of negotiations with his Beijing counterparts.

Peer MP Materials also declined -7.40%.

Harley-Davidson Inc. (HOG) 4.4%

HOG fell 4.4% to $26.98. Morgan Stanley downgraded the motorcycle maker to underweight from equalweight.

It also reduced its price target to $25 from $27.

🧠 Technical Trip

Interview Q&A from Moelis

👉 Want 1-on-1 recruiting help from Moelis bankers & 2,000+ top mentors? Apply to WSO Academy

🦈 Deal Dispatch

M&A, IPOs, And Other Notable Transactions

Domino’s Pizza Enterprises soars on a report that Bain is eyeing a takeover.

Sany Heavy Industry shares advance in Hong Kong trading debut.

EQT offers to buy Australian insurer AUB in $3.4 billion deal.

Google to buy power from NextEra nuclear plant, which is being revived.

Nvidia, Deutsche Telekom plan €1 billion German data center.

Banijay is said to be in talks to acquire CVC’s betting firm Tipico.

Buyout giant Vista buys Nexthink stake from Permira in a bet on AI.

Banana Brain Teaser

Previous

Machine A produces bolts at a uniform rate of 120 every 40 seconds, and Machine B produces bolts at a uniform rate of 100 every 20 seconds. If the two machines run simultaneously, how many seconds will it take for them to produce a total of 200 bolts?

Answer: 25

Today

[(0.0036) x (2.8)]/[(0.04) x (0.1) x (0.003)] = ?

If a business does well, the stock eventually follows.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mitchell, Colin, & Patrick