- The Peel

- Posts

- Amazon Bets Big on Sales

Amazon Bets Big on Sales

📦 Amazon extends Prime Day into Prime Week, with sales expected to hit billions as advertising and Prime memberships take center stage.

In this issue of the peel:

✈️ United Airlines stock jumps as Delta’s bullish forecast lifts sentiment across the airline sector, reviving optimism in post-pandemic travel.

📦 Amazon extends Prime Day into Prime Week, with sales expected to hit billions as advertising and Prime memberships take center stage.

🇺🇲 Trump reignites trade tensions, announcing tariffs on eight nations, including Brazil, despite a shrinking U.S. GDP.

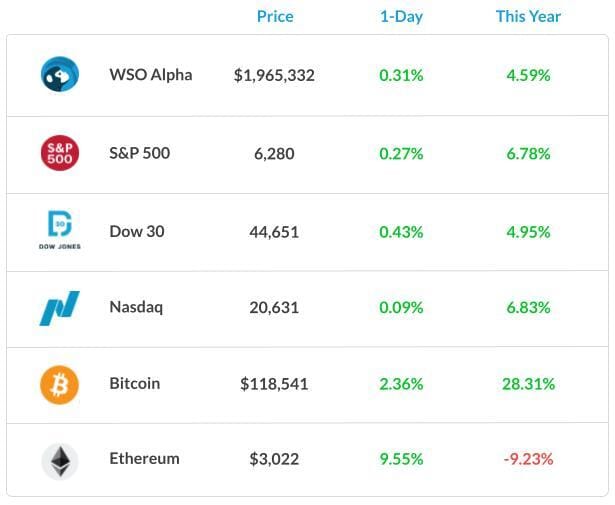

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Mitchell Ang, put together an impressive deep dive on Robinhood, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

Trump targets Canada (again) and proposes 35% tariffs on Canadian cars and metals, escalating trade tension.

Boston Consulting Group quietly leads a $500M aid initiative for Gaza reconstruction post-conflict.

Harvard’s political pivot? The school faces backlash after launching a conservative scholarship center amid Trump criticism.

Taiwan counters China’s pressure with military drills and patriotic education campaigns.

The UK economy stumbles with GDP contracting for the second straight month, fuelling fears of a technical recession.

Jobless claims dip with U.S. unemployment claims falling to 222,000, suggesting continued labor market resilience.

The Daily Poll

Will these tariffs actually help U.S. jobs? |

Previous Poll:

Will tariffs impact inflation long-term?

Definitely: 50% // Maybe: 26.3% // One-time bump: 16.7% // Not at all: 7.0%

Tilt the Odds in Your Favor

In the competitive world of high finance, every advantage counts. Our exclusive curriculum, designed by industry experts, sharpens your skills and knowledge, making you a top candidate.

Enjoy personalized coaching, targeted internship opportunities, and a robust network of finance professionals with WSO Academy.

» Apply Now «

Macro Monkey Says

Make Tariffs Great Again

In a major trade policy move, Donald Trump has slapped new tariffs on eight countries, including Brazil, the Philippines, Iraq, and Sri Lanka, as part of his revived “America First” agenda.

The new measures, announced via Truth Social, assign import tax rates ranging from 20% to a whopping 50%, with Brazil receiving the harshest treatment. Trump accused Brazil of "grave injustices" tied to censorship and election interference, despite the U.S. actually enjoying a $7.4B trade surplus with the country.

Other targets like Algeria, Moldova, and Brunei are being hit with 25–30% tariffs, with Washington citing persistent trade imbalances. The Census Bureau reported that last year, the U.S. ran a trade deficit on goods of:

$2.6bn with Sri Lanka

$1.4bn with Algeria

$5.9bn with Iraq

$900m with Libya

$4.9bn with the Philippines

$111m with Brunei

$85m with Moldova

However, these collectively amount to pocket change in a $30T U.S. economy. Trump’s justification? Defending American industry and jobs, even as the latest U.S. GDP report shows a 0.5% contraction, and job growth in trade-related sectors has stagnated.

Markets stayed relatively calm but watchful. Some economists warn that if these measures stick, they could clip GDP growth by up to 0.3% over the next 12 months due to tighter trade flows. Others see this more as political theater than policy, for now.

U.S. Tariffs as of July 7, 2025

The Takeaway?

Donald Trump has announced new tariffs on eight countries, including Brazil, the Philippines, and Iraq, citing trade imbalances and political concerns. Brazil faces the steepest rate at 50%, while others received 20–30%.

Despite modest U.S. trade deficits with most of these countries, the move risks global trade friction. With U.S. GDP shrinking 0.5% and job growth slowing in key sectors, the economic impact could grow if retaliation or supply chain disruptions follow.

Career Corner

Question

I have a question about applying for positions on the website and networking. Should I apply to a firm first and then connect with employees to set up calls, or should I reach out to employees at the firm, connect with them, and schedule a call before applying for a position? What would be the best strategy? Could a mentor assist me with this?

Answer

It depends on specific roles and timelines. Ideally, networking before applying is beneficial, but if the application is open, you must submit it. You don’t want to be left out of the process just because you were too late! Most of these applications are rolling, so if you wait too long to apply, you could miss it entirely.

Head Mentor, WSO Academy

What's Ripe

United Airlines Holdings Inc. (UAL) 14.3%

United Airlines soared 14.3% on Thursday, buoyed by a sector-wide rally ignited by Delta Air Lines' optimistic profit forecast. Delta's announcement of improved profit expectations, attributed to stabilized bookings and cost controls, lifted investor sentiment across the airline industry.

United, benefiting from this positive outlook, saw its shares climb, reflecting renewed confidence in the sector's recovery prospects.

American Airlines Group Inc. (AAL) 12.7%

American Airlines experienced a 12.7% surge in its stock price, riding the wave of optimism following Delta Air Lines' strong earnings forecast. Delta's positive outlook signaled potential industry-wide improvements, prompting investors to reevaluate prospects for other major carriers.

American Airlines, as a significant player in the sector, benefited from this renewed investor enthusiasm.

What's Rotten

Atlassian Corp (TEAM) 9.4%

Atlassian's shares declined by 9.4% on Thursday following regulatory filings revealing that CEO Mike Cannon-Brookes sold approximately $1.6 million worth of company stock. Specifically, Cannon-Brookes sold 7,665 shares.

Co-founder and former CEO Scott Farquhar also sold an identical number of shares. These transactions follow a pattern of recent stock sales by both executives earlier in the month.

As a result of the downturn, Atlassian's stock has declined by approximately 17.5% in 2025, in contrast to a roughly 7% gain in the S&P 500 during the same period.

Axon Enterprise Inc (AXON) 9.0%

Axon Enterprise saw its stock fall by 9.0%, as investors reacted to concerns about the company's growth trajectory and market valuation. While Axon has demonstrated strong year-to-date performance, the recent decline suggests a market reassessment of its future earnings potential and the sustainability of its growth amid competitive pressures.

Thought Banana

Prime Day? Try Prime Week

Amazon’s Prime Day has quietly morphed into Prime Week, and no one seems to be complaining, least of all advertisers. Originally billed as a two-day sales event, the 2025 version now runs from July 8 to 11, and U.S. sales are projected to hit a record-breaking $12.9 billion, a massive 53% jump from last year.

What’s changed? For starters, advertising is now the engine behind the deals. Retailers pay Amazon to show up in search results and push discounts, making the platform feel more like a monetized bazaar than a traditional marketplace. The longer the sale lasts, the more ad space Amazon can sell, and the more opportunities brands have to nudge you into that “lightning deal.”

Meanwhile, Amazon’s real goal is Prime membership growth. The company is dangling exclusive deals to encourage sign-ups and retain subscribers, which helps pad its recurring revenue base. It’s also a clever counterattack against rivals like Walmart and Target, who have launched competing summer sales of their own.

So, what started as a shopping holiday has become a marketing arms race. Amazon’s no longer just slashing prices; it’s monetizing every click, scroll, and second of your attention.

The Takeaway?

Amazon has extended its Prime Day into a four-day event, from July 8 to 11, 2025, aiming to attract more shoppers and advertisers. U.S. sales are projected to hit a record $12.9 billion, up 53% from the previous year.

The extended sale period offers advertisers increased opportunities to engage consumers, while Amazon seeks to boost Prime memberships and counter rival retailers launching their own sales events.

The Big Question: Can Amazon keep turning shopping into a subscription funnel, without burning out Prime customers?

Banana Brain Teaser

Previous

If a two-digit positive integer has its digits reversed, the resulting integer differs from the original by 27. By how much do the two digits differ?

Answer: 3

Today

For the past n days, the average daily production at a company was 50 units. If today’s production of 90 units raises the average to 55 units per day, what is the value of n?

Send your guesses to [email protected]

Do not wait for the perfect moment. Take the moment and make it perfect.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Mithun, Colin & Patrick