- The Peel

- Posts

- All Eyes on Earnings

All Eyes on Earnings

🤵All eyes are on tech as Microsoft, Meta, Apple, and Amazon set to announce earnings this week.

In this issue of the peel:

♭ Markets held their ground after trade progression ahead of the August 1st trade deadline.

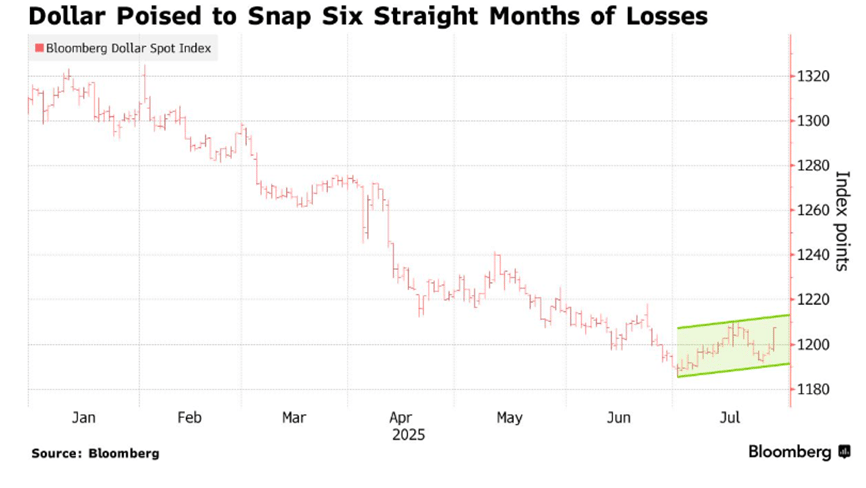

🌯The dollar jumps off investor confidence surrounding trade as the U.S agreed to lower their tariff rate on the EU, along with other conditions.

🤵All eyes are on tech as Microsoft, Meta, Apple, and Amazon set to announce earnings this week.

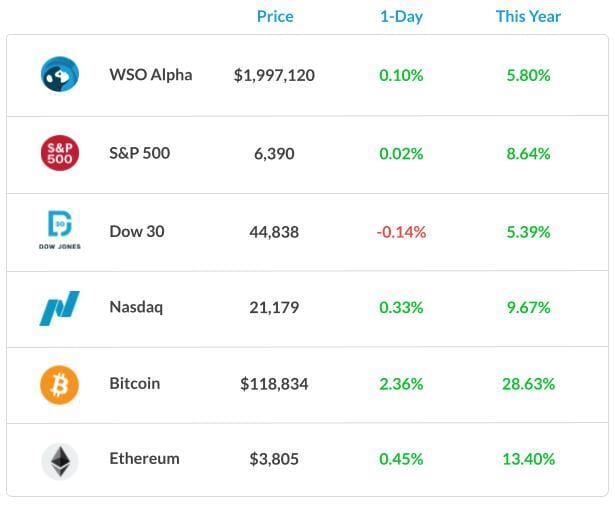

Market Snapshot

Student Spotlight

A+ Equity Research Report 📊

Looking for a stellar example of what makes an equity research report stand out?

One of our WSO Academy students, Sebastian Morar, put together an impressive deep dive on Flywire Corp, covering valuation, catalysts, and key risks with the kind of insight that turns good pitches into great ones. Check out the report here:

Banana Bits

The U.S housing market posted its worst selling season in over 13 years.

The U.S dollar jumped the most since May in light of trade agreements.

Russia had banned gasoline producers from exporting fuel until the end of August to meet accelerated demand initially disrupted by Western Sanctions.

President Donald Trump’s tariffs are reportedly stunting global economic growth, but markets seem to be dismissing it entirely.

🚀Find Your Next Internship or Job with Inbox to Intern!

Inbox to Intern delivers handpicked finance, accounting, and business internships and job opportunities straight to your inbox every week — saving you time and keeping you ahead in your career search.

Subscribe today to get exclusive access to the latest roles, application tips, and career insights.

Macro Monkey Says

Trade Deal? Markets Want Earnings

Over the weekend, the U.S and the EU came to a trade deal where the Trump Administration agreed to lower tariffs from 30% (which was the rate to go into effect August 1st) to 15%, in addition to a few other contingencies.

In return for lowering the effective tariff rate, the EU agreed to buy $750 billion worth of “energy-related goods,” in addition to investing another $600 billion into the U.S. President Donald Trump went on to comment that the deal was “the biggest deal ever made.”

Markets also remained relatively stable yesterday, as on Wednesday and Thursday, there will be major big tech earnings announcements. Microsoft and Meta are set to announce earnings on Wednesday, while Amazon and Apple are announcing on Thursday.

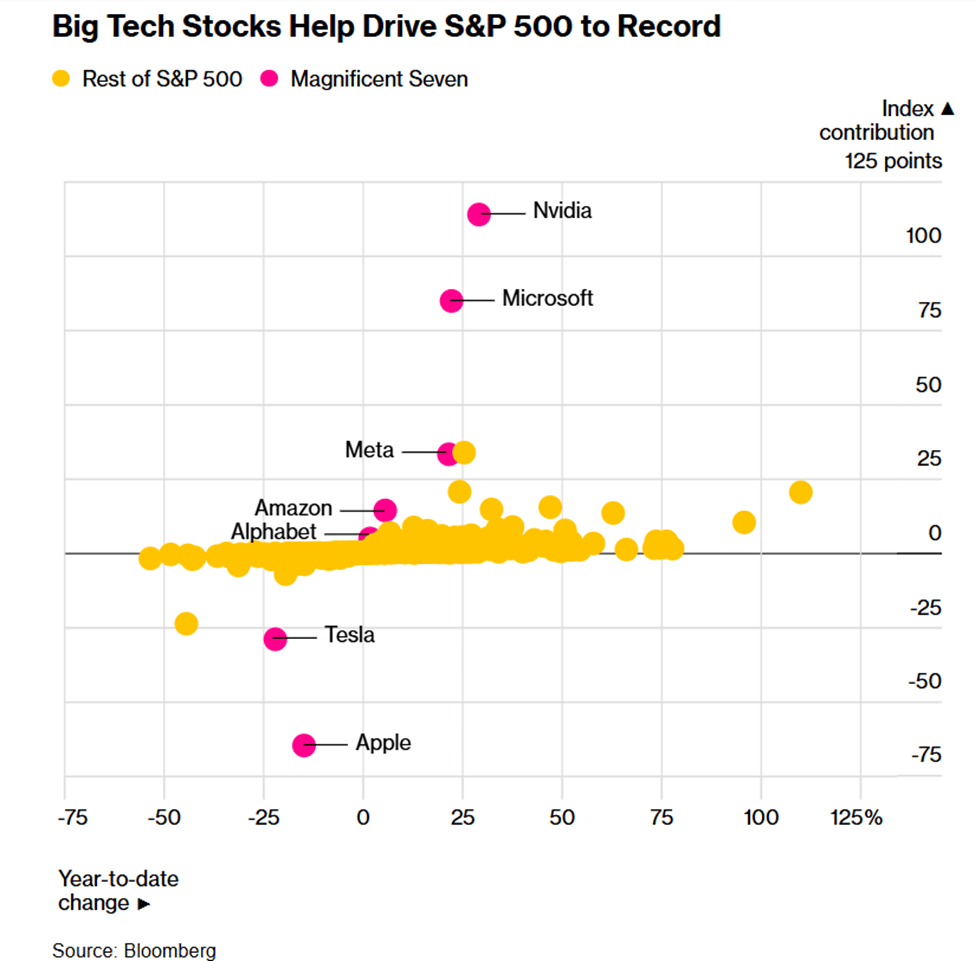

All four of these companies are earnings of the “Magnificent Seven,” and their performance will be critical if the S&P 500 is to continue its historic rally. Additionally, Meta and Microsoft were two of the top 3 most successful holdings in the S&P, right behind Nvidia.

Furthermore, the “Magnificent 7” has accounted for a little over 20% of the weighted market cap of the S&P 500, therefore being a significant driver of the S&P’s gains.

Roughly 82% of the companies in the S&P 500 that have reported (about 33% of the S&P have reported thus far) have beaten analyst expectations, and many have high hopes for big tech this week.

Despite the overall earnings success, it is important to note that many analysts significantly slashed expectations as a result of Trump’s sweeping tariffs, so that could be a significant driver of earnings success within the S&P.

Overall, if markets are to continue the ongoing upward trend, these companies are going to have to not only beat expectations but also keep their guidance elevated as valuations for big tech companies keep climbing.

What's Ripe

Scilex Holding Company (SCLX) 29.8%

Scilex is a pharmaceutical company known for their non-opioid pain management drugs. Scilex’s share price skyrocketed yesterday after an analyst upgrade in conjunction with an overall bullish sentiment from investors, resulting from regulatory and approval milestones for Scilex. Scilex is up over 163% in the past month.

Stem Inc. (STEM) 26.2%

Stem, an AI-driven clean energy solutions company, saw its stock price soar yesterday after they announced a recapitalization deal. This deal announced the reduction of convertible notes by $195 million, the issuance of $155 million of first-lien secured notes, in addition to raising $10 million in cash.

This recapitalization allowed Stem to have significantly improved liquidity in addition to extended maturities, essentially allowing them to be in a better position for long-term growth.

What's Rotten

Chargepoint Holdings, Inc. (CHPT) 18.9%

Chargepoint Holdings, an EV (electric vehicle) solutions company, witnessed its share price plummet yesterday as they missed earnings, also resulting in analyst downgrades, further fueling investor selloff.

Chargepoint also announced a 1-20 reverse stock split in order to increase its share price in order to maintain NYSE regulations.

Albemarle Corporation (ALB) 10.7%

The share price of Albemarle, a chemical company specializing in lithium solutions, plummeted yesterday after sector-wide lithium volatility. This volatility was induced by China suspending lithium mining at eight different mines. Financial institutions like Scotiabank said the lithium rebound of 30% in the past few months was “transitory” and maintained a hold rating.

Thought Banana

Dollar Bounces After Historic Slide

The U.S dollar jumped the most since early May amidst the trade deal announced between the U.S and the EU. This gain puts the U.S dollar on track for its first monthly gain in 2025.

When the trade deal was announced, the dollar soared above all other currencies in the Group of 10, with the Euro falling the most since the 15% tariff rate was set above the 10% universal rate the Trump Administration has set into place.

Aroop Chatterjee, a strategist at Wells Fargo, said that “actual tariffs will be negative for the rest of the world’s growth,” given the asymmetry of the deals.

On top of that, many global economists are arguing that Trump’s “American protectionism” (through tariffs) is extremely transparent, despite the lack of response from the financial markets.

While President Donald Trump has announced trade deals with the EU, for example, countries that have not cut out deals yet have been promised higher tariff rates as the August 1st deadline is only days away.

The current tariff level hasn’t been this high since the 1930s, and is currently six times what it was before Trump took office.

Despite the lowered tariffs from Liberation Day, some economists believe the worst is yet to come when companies freeze capital spending, reroute supply chains, and cut margins to absorb rising costs, potentially causing a market selloff.

The Big Question: Will Trump’s tariff-fueled protectionism boost U.S. markets—or backfire on global growth and investor confidence?

Banana Brain Teaser

Previous

What is the difference between the 6th and the 5th terms of the sequence 2, 4, 7, … whose nth term is n + (2)^(n - 1)?

Answer: 17

Today

30% of the members of a swim club have passed the lifesaving test. Among the members who have not passed the test, 12 have taken the preparatory course and 30 have not taken the course. How many members are there in the swim club?

Send your guesses to [email protected]

The real key to making money in stocks is to not get scared out of them.

How Would You Rate Today's Peel?

Happy Investing,

Chris, Vyom, Ankit, Colin, & Patrick